Overview of Crypto Pump and Dump Schemes

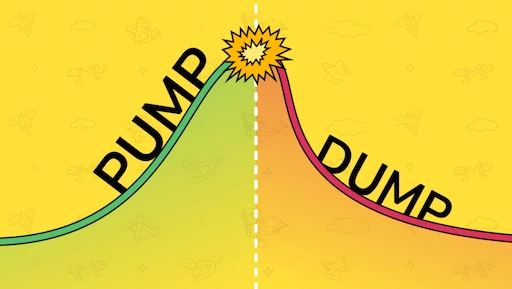

In the rapidly evolving world of cryptocurrency, pump and dump schemes have become a prevalent form of market manipulation. A pump and dump is a fraudulent trading tactic that involves artificially inflating the price of a cryptocurrency through false or misleading statements, only for the perpetrators to sell off their holdings once the price has spiked, resulting in heavy losses for unsuspecting investors.

The “pump” refers to the sudden surge in price, typically driven by coordinated marketing efforts such as social media hype, influencer endorsements, or rumors. The “dump” happens when these orchestrators quickly sell off their positions at the inflated prices, causing the market price to plummet.

Such schemes are particularly common in the cryptocurrency market due to its decentralized nature, limited regulation, and the ease with which information can be manipulated. The volatility inherent in cryptocurrency markets makes them ripe for such schemes, and they pose significant risks to uninformed traders.

Historical Context and Trends in Crypto Pump and Dump Schemes

Although the concept of pump and dump schemes is not new, their prominence in the crypto world has increased dramatically in recent years. These schemes are not unique to cryptocurrency, as they have existed in traditional stock markets for over a century. However, the rise of digital currencies and decentralized platforms has amplified their occurrence.

In traditional finance, pump and dump tactics were often carried out through direct manipulation by investors or coordinated groups who would artificially inflate the price of penny stocks. The same strategies have found fertile ground in the crypto space, where new tokens or lesser-known altcoins often receive the bulk of the manipulation.

Historically, the crypto boom around 2017-2018 saw an explosion in pump and dump schemes, with the popularity of altcoins like Dogecoin, Shiba Inu, and others being partially driven by such efforts. However, even in 2024, despite growing awareness, pump and dump scams continue to plague the market, particularly with new or unregulated coins.

Identifying Pump and Dump Tokens

Recognizing a pump and dump scheme can be challenging, especially for those new to the crypto space. However, there are several red flags to look out for:

1. Sudden Price and Volume Surges

The most obvious indicator of a pump is a drastic and sudden increase in the token’s price or trading volume. If there is no legitimate news, announcement, or update to justify this jump, it’s worth being suspicious. A legitimate coin will experience more organic, steady growth over time, driven by adoption or innovation.

2. Hyped Social Media Activity

A well-coordinated pump and dump often involves influencers or organized groups promoting a coin through social media platforms like Twitter, Telegram, or Reddit. These groups will often hype the coin by posting statements such as “This coin will explode!” or “Get in now before it’s too late!” They may also use specific hashtags to create a viral buzz.

3. Lack of Transparency or Clear Use Case

Newly launched tokens with little to no technical whitepaper, clear use case, or identifiable development team are more likely to be manipulated. Legitimate projects usually provide in-depth information on their goals, tokenomics, and roadmaps. If you cannot easily find this information, proceed with caution.

4. Influencer Manipulation

In some pump and dump schemes, well-known influencers in the crypto space are paid to promote a coin. These influencers may have millions of followers, many of whom may not realize they are being manipulated. If an influencer is promoting a coin without providing a detailed review or analysis, it’s wise to be cautious.

5. Excessive Promises of “Quick Gains”

Any project or individual promising you fast, guaranteed returns is a red flag. Crypto markets are volatile, and no legitimate project can guarantee profits. Scam projects often use phrases like “Get in now!” or “This is the next big thing!” to create an artificial sense of urgency.

Case Studies: High-Profile Pump and Dump Scams

To better understand the scale and impact of these schemes, let’s take a look at some notorious cases:

1. BitPetite (2018)

BitPetite was a relatively unknown token that saw its price spike from $0.001 to $0.20 in a matter of days, after being aggressively pumped by a group of traders. Once the price had surged, the group dumped their holdings, leading to a crash, and many investors were left with worthless tokens. This case highlighted how easily coordinated groups could manipulate cryptocurrency prices with little to no effort.

2. Bitcoin Private (BTCP)

In early 2018, Bitcoin Private, a fork of Bitcoin, experienced significant volatility when a pump and dump scheme was orchestrated. Promoted by anonymous individuals on social media, the price surged due to mass buying from retail investors. However, once the manipulative traders sold off their holdings, the coin’s value dropped sharply, and many investors were left with large losses. The Bitcoin Private incident underscored how even established cryptocurrencies could fall prey to price manipulation.

3. “Pump Groups” on Telegram

Telegram pump groups are often created for the express purpose of organizing coordinated schemes. In these groups, the members are told exactly when to buy and sell a certain cryptocurrency. These groups are highly secretive and tend to push obscure, low-volume coins to artificially inflate their price. As soon as the target price is reached, the orchestrators “dump” their coins, causing the price to crash.

Psychological Factors Behind Pump and Dump Schemes

Pump and dump schemes prey on several psychological factors that influence trader behavior:

1. Greed

Humans are wired to seek profit, and crypto markets are often seen as a place to get rich quickly. The promise of easy profits lures many people into these schemes, as they believe they can capitalize on rapid gains.

2. Fear of Missing Out (FOMO)

FOMO is a powerful psychological factor in the cryptocurrency market. When people see others profiting from a rapidly rising asset, they rush to invest, hoping to capitalize on the same gains. This creates an artificial demand, fueling the pump.

3. Herd Mentality

In volatile markets like crypto, people often look to others for cues on how to act. If a large group of traders is buying a particular coin, others may follow suit without doing their own research, increasing the likelihood of manipulation.

Regulatory Challenges in the Crypto Market

One of the key issues with crypto pump and dump schemes is the lack of regulation. Unlike traditional financial markets, where regulators like the SEC (U.S. Securities and Exchange Commission) keep a close eye on market manipulation, the crypto space is relatively free from oversight. Cryptocurrencies exist in a decentralized environment, making enforcement of existing laws difficult.

While some countries have started to implement regulations or crack down on fraud in the crypto space (such as China, which has imposed strict crypto bans, or the U.S., which has introduced some crypto-specific regulations), there is no unified global framework in place to stop such activities. This lack of regulatory clarity makes it challenging for investors to know which markets and exchanges are safe to trade on.

How to Protect Yourself From Crypto Pump and Dump Schemes

Understanding how to avoid falling for these scams is key to protecting your investments:

1. Do Your Own Research (DYOR)

Always conduct your own research before buying any cryptocurrency. This means reading the whitepaper, researching the development team, and checking if the token has any legitimate use case.

2. Avoid FOMO and Impulsive Buying

Be wary of jumping into a coin because everyone else is talking about it. FOMO can cloud your judgment and lead to hasty decisions that result in losses.

3. Stick to Reputable Exchanges

Choose well-established and regulated exchanges with strong reputations in the crypto community. Platforms like Coinbase, Binance, and Kraken have been around for years and are less likely to be associated with pump and dump activities.

4. Diversify Your Portfolio

Never put all your money into one token, especially a low-market-cap coin with questionable credentials. Diversification reduces risk and ensures that you’re not overexposed to any one asset.

5. Be Cautious of Influencers and Social Media Hype

While some influencers are legitimate, many are paid to promote coins in exchange for compensation. Always verify any claims made by social media figures before making investment decisions.

6. Set Clear Investment Goals

Establish clear financial goals and don’t let short-term market fluctuations derail your strategy. Long-term thinking can protect you from the impulsiveness driven by pump and dump schemes.

Conclusion

Crypto pump and dump schemes are one of the most dangerous forms of market manipulation in the cryptocurrency space. They can result in significant financial loss for those caught in the frenzy. However, with awareness and caution, you can protect yourself from these scams.

By conducting thorough research, ignoring hype, and being cautious of sudden price movements, you