Cryptocurrency has become one of the most talked-about and disruptive innovations in recent years. With its promise of decentralization, freedom from traditional banking, and the potential for high returns, it’s no wonder that millions of people worldwide are diving into the crypto space. However, despite the many advantages and opportunities that come with owning and using digital currencies, it is essential to recognize that the crypto space is riddled with risks. From scams and hacks to market volatility and regulatory uncertainty, those who venture into the world of cryptocurrency must proceed with caution.

In this blog post, we’ll explore some of the key risks associated with the cryptocurrency market and offer practical advice on how to protect yourself from potential losses, fraud, and security breaches.

1. Market Volatility: Prices Can Swing Wildly

One of the most significant risks associated with cryptocurrency is market volatility. Unlike traditional stocks or bonds, the prices of cryptocurrencies like Bitcoin, Ethereum, and other altcoins can experience drastic swings in short periods of time. For example, Bitcoin has been known to rise by thousands of dollars in a matter of days, only to drop just as quickly.

Why is this a risk?

- Unpredictability: The crypto market is relatively young compared to traditional financial markets, which makes it prone to wild price fluctuations based on news, speculation, or even social media trends. A tweet from an influential figure can send prices soaring or crashing.

- Psychological Stress: If you’re investing significant portions of your portfolio in cryptocurrencies, the volatility can be emotionally taxing. Watching your investment fluctuate so drastically can lead to impulsive decisions—such as panic selling when prices drop or buying in at the peak of a market rally.

How to protect yourself:

- Don’t Invest More Than You Can Afford to Lose: Given the inherent volatility, only invest what you’re prepared to lose. Cryptocurrencies are not a “get rich quick” investment but should be treated as part of a diversified portfolio.

- Use Dollar-Cost Averaging (DCA): Instead of trying to time the market, consider using DCA, where you invest a fixed amount at regular intervals. This can help smooth out market fluctuations and reduce the impact of short-term volatility.

- Set Stop-Loss Orders: Many exchanges allow you to set automatic sell orders at certain price points, which can help limit losses if the market moves against you.

2. Scams and Fraud: Deceptive Schemes Are Everywhere

Cryptocurrency’s decentralized, anonymous nature has unfortunately attracted scammers and fraudsters who prey on uneducated or unsuspecting investors. Whether it’s fake ICOs (Initial Coin Offerings), Ponzi schemes, or phishing attacks, the crypto space is rife with fraudulent activity.

Common scams in the crypto space include:

- Phishing Attacks: Scammers impersonate legitimate exchanges, wallets, or influencers to trick you into revealing your private keys or login credentials. They often do this via email, social media, or fake websites.

- Ponzi Schemes and Fake ICOs: Some projects promise huge returns but are just designed to take your money. They rely on new investors to pay off earlier ones, and the project collapses once new investments stop flowing in.

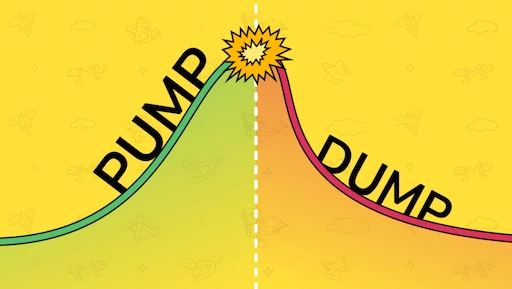

- Pump and Dump Schemes: Coordinated groups of traders manipulate the price of a cryptocurrency by artificially inflating its value and then selling it off, leaving others with worthless tokens.

How to protect yourself:

- Verify Everything: Always double-check the legitimacy of any project, exchange, or offer before committing your funds. Look for reviews, and check if the team behind the project is known and reputable.

- Enable Two-Factor Authentication (2FA): Whenever possible, enable 2FA on your exchange and wallet accounts to add an extra layer of protection against unauthorized access.

- Use Reputable Platforms: Stick to well-known and established cryptocurrency exchanges, wallets, and platforms that have a proven track record. Avoid unsolicited investment opportunities or “too good to be true” promises.

- Be Skeptical of Unsolicited Offers: If you receive an unsolicited email or message claiming to offer a “surefire” investment opportunity or “guaranteed returns,” treat it as a red flag. No legitimate investment guarantees profits.

3. Hacks and Security Breaches: Your Crypto Could Be Stolen

Because cryptocurrencies are digital assets and largely unregulated, they are a prime target for hackers. Whether through vulnerabilities in exchanges, wallet services, or even in user behavior, the risk of theft is very real.

Common hacking incidents include:

- Exchange Hacks: Centralized exchanges like Mt. Gox and Binance have been hacked in the past, leading to the loss of millions of dollars worth of crypto. Hackers often exploit security flaws in exchanges to steal users’ funds.

- Wallet Vulnerabilities: If you store your cryptocurrency on a wallet that isn’t properly secured, hackers may be able to access it. Even hardware wallets can be compromised if they’re not used properly.

- Social Engineering Attacks: Hackers can trick you into revealing your private keys or recovery phrases via social engineering tactics, including impersonation or fake giveaways.

How to protect yourself:

- Use Hardware Wallets for Long-Term Storage: If you’re not actively trading, consider storing your crypto in a hardware wallet (like a Ledger or Trezor). These offline wallets are much less susceptible to hacking than those kept on exchanges or online wallets.

- Withdraw Funds to Private Wallets: Never leave large amounts of cryptocurrency on an exchange for extended periods. If you aren’t actively trading, withdraw your funds to a private wallet.

- Regularly Update Security: Use strong, unique passwords, and regularly update your software (both on your computer and on any wallets you use). Install antivirus software, and avoid downloading or clicking on suspicious links.

- Beware of Phishing: Be cautious of unsolicited communications or fake websites. Always verify the URL of any exchange or wallet site before entering sensitive information.

4. Regulatory Uncertainty: Governments Are Watching

One of the biggest risks in the crypto space is the lack of regulation and the uncertainty surrounding how governments will treat digital assets in the future. Cryptocurrency regulations vary widely from country to country, and in many cases, they’re still being developed.

Risks posed by regulatory uncertainty:

- Tax Implications: In many countries, the tax treatment of cryptocurrencies is still unclear. In some regions, crypto trading is subject to capital gains tax, while in others, it may be treated as income. Failing to comply with tax regulations can result in fines or penalties.

- Government Crackdowns: In some countries, governments have banned or heavily regulated cryptocurrencies, which can create a hostile environment for crypto users. Any sudden regulatory action could impact the value of certain assets or the ability to access exchanges.

How to protect yourself:

- Stay Informed About Local Regulations: Keep up-to-date with any legal developments in your country or region. Understanding the tax implications and any restrictions related to crypto will help you avoid legal issues.

- Consider Using Decentralized Platforms: If you’re concerned about government intervention, consider using decentralized exchanges (DEXs) and decentralized finance (DeFi) platforms, which are harder to regulate and censor.

5. Loss of Private Keys: You Lose Your Crypto Forever

One of the unique aspects of cryptocurrency is the importance of private keys. These are the cryptographic keys that control your access to your crypto holdings. If you lose your private key or recovery phrase, there is no central authority (like a bank) to recover your funds. It’s gone—forever.

Why is this a risk?

- Irreplaceable Keys: If you lose the private key or recovery phrase associated with a cryptocurrency wallet, there is no way to recover your funds. This is especially dangerous for long-term holders who store large amounts of crypto.

- Human Error: Many users forget to back up or securely store their private keys, putting their funds at risk.

How to protect yourself:

- Back Up Your Private Keys: Always make sure you back up your private keys or recovery phrases in multiple secure locations. Never store them digitally without encryption, and avoid storing them on your computer or online where they can be hacked.

- Use Multi-Signature Wallets: Consider using a multi-signature wallet, which requires more than one key to authorize a transaction, providing an extra layer of security.

Conclusion: Navigating the Risks of Crypto Safely

The cryptocurrency space offers a wealth of opportunities, but with those opportunities come substantial risks. From market volatility and scams to security breaches and regulatory uncertainty, it’s crucial to be vigilant and proactive in protecting your digital assets. By following best practices for security, staying informed, and only investing what you can afford to lose, you can minimize your risks and maximize your chances of success in the world of crypto.

Remember: the decentralized nature of cryptocurrency means you’re in control of your assets—but it also means you’re solely responsible for keeping them safe. Proceed with caution, and always prioritize security above all else.